The markets are closed today, so I'm going to keep this short.

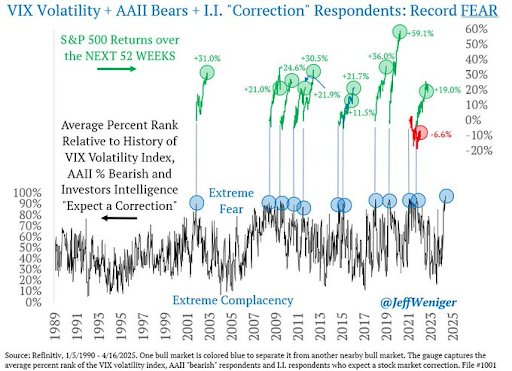

Jeff Weniger tweeted this chart.

He writes: “You're looking at the highest reading on record in 1,841 weekly stock market sentiment observations from 1990 to 2025.

The inputs: the VIX volatility index + AAII survey bearish respondents + Investors Intelligence survey respondents who expect a correction.

In 10 of the last 11 fear spikes, the S&P 500 went on to gains over the next 52 weeks. Returns were often large too (+31.0%, +21.0%, and so on).”

That's pretty compelling. Great constrarians zig when the market zags. There is record fear in the market but the economic numbers are actually pretty good. Lets think about the bullish case for U.S. stocks and peer at the glass as if it were half full:

- Nonfarm payrolls added 228,000 jobs in March (vs. 140,000 expected).

- The Consumer Price Index (CPI) fell 0.1% in March 2025, lowering the 12-month rate to 2.4% (from 2.8% in February), the lowest since September 2024.

- Crude oil, a major input cost, is trading way down at $64 a barrel.

- S&P 500 earnings are expected to be up 7.3% year over year. That’s not bad.

- The EU and China are ramping up spending.

- AI and Robotaxis are going to change the world faster than you think.

- The Fed will cut rates at some point.

- Housing affordability is getting better allowing renters to spend more on stuff.

- Capex on U.S. based factories is booming.

- Tariffs, or rather the deals made after the tariff threat ends, could actually increase trade as forign markets drop their import walls.

- Value metrics such as PE and PS have dropped.

There is a solid argument to be made that the correction has already happened. I am seeing lots of charts of speculative tech companies that look like great buys. We are just entering earnings season with some potential bullish surprises. Don’t be shocked if we get a big rally out of this.

All the best,

Christian DeHaemer

.